38 loan syndication process diagram

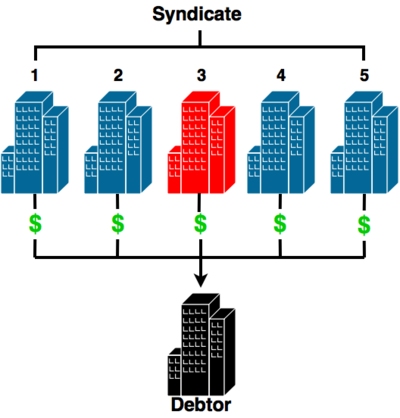

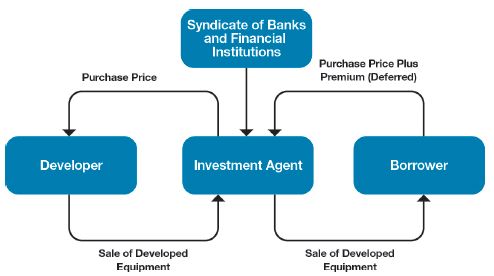

A syndicated loan is a loan made respectively by two or more lenders contracting directly with a borrower under the same credit agreement with the lenders dividing the responsibility to lend the full amount of the loan. Each lender has a direct legal relationship with the borrower and receives its own promissory note from the borrower.

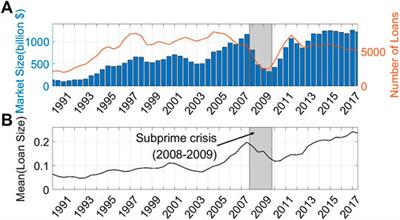

Figure 1—Loan Share Retained by the Originating Bank and Loan Issuance Volume Notes: The graph is compiled from DealScan database of loan originations and corresponds to US, nonfinancial syndicated loans. Lead share is a three-month rolling window average (equally weighted). Loan issuance is the total issuance in a given quarter.

A syndicated loan (or 'syndicated bank facility') is a large loan in which a group of banks work together to provide funds for a borrower. A syndicated loan is the opposite of a bilateral loan, which only involves one borrower and one lender1. The cost of a syndicated loan consists of interest and several management

Loan syndication process diagram

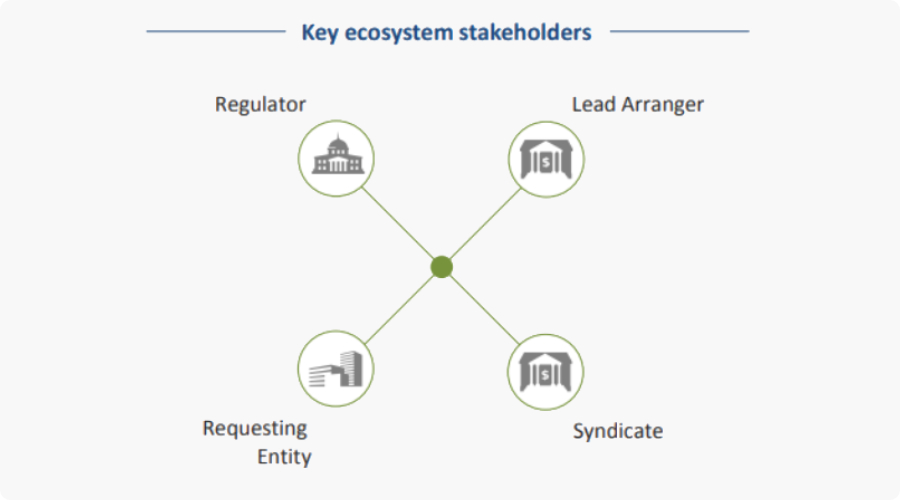

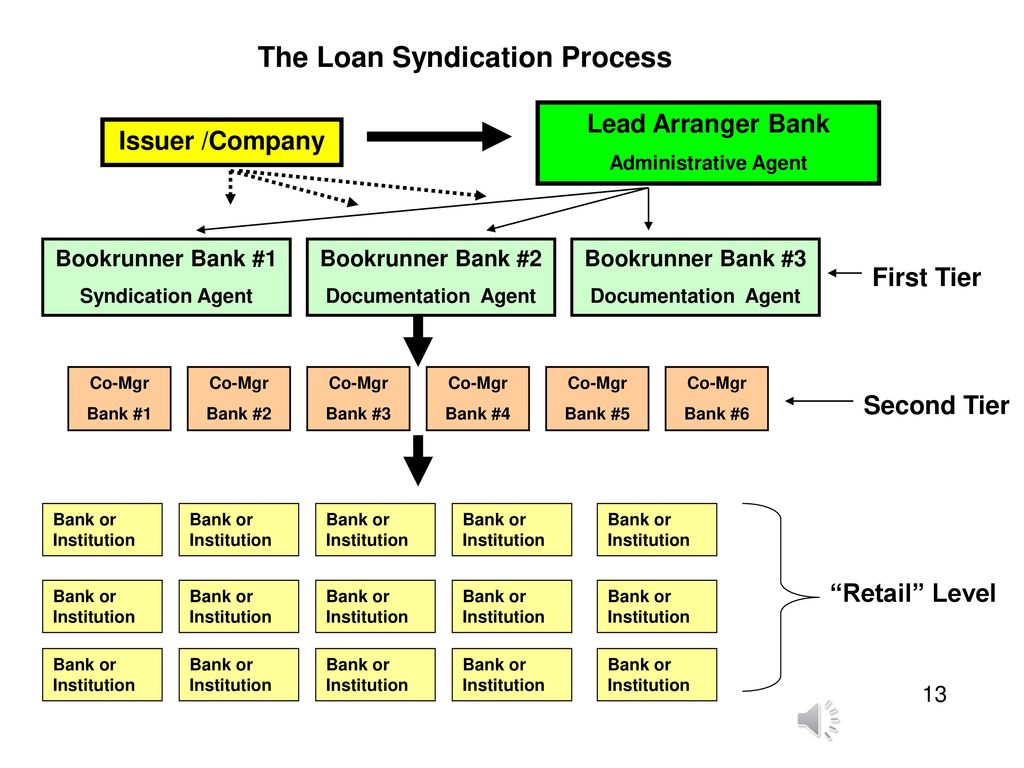

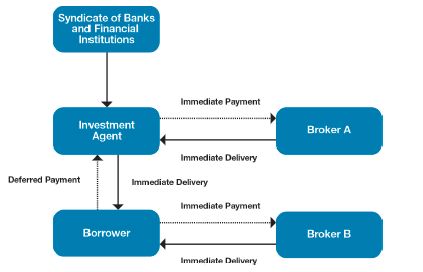

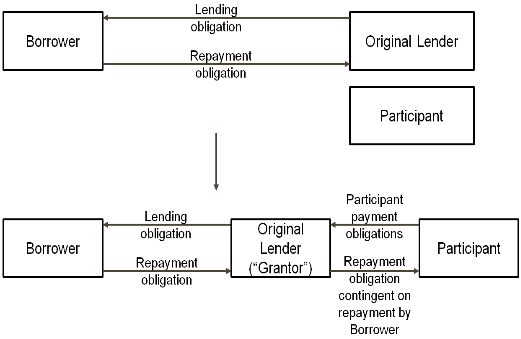

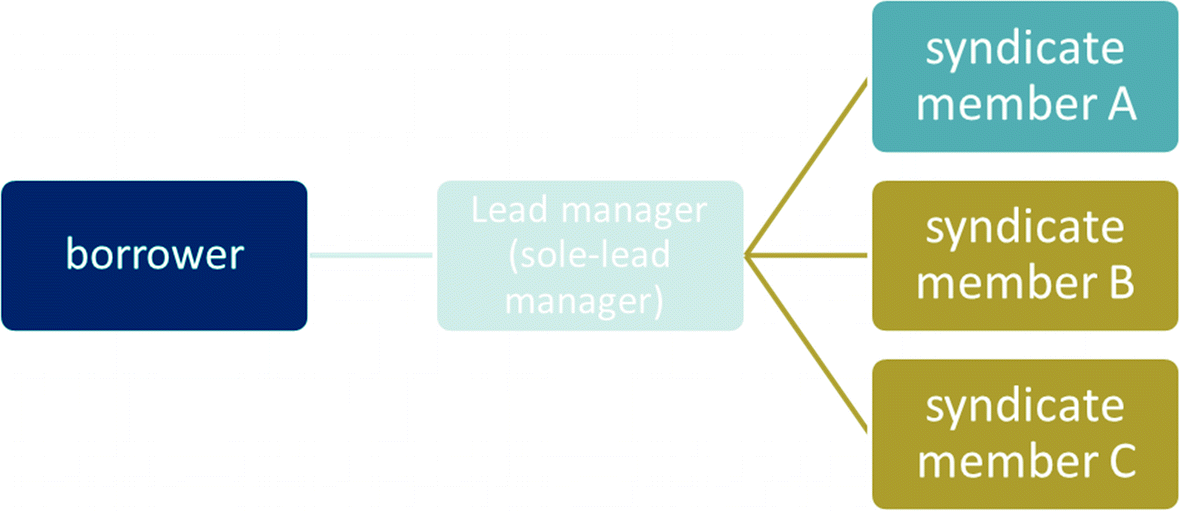

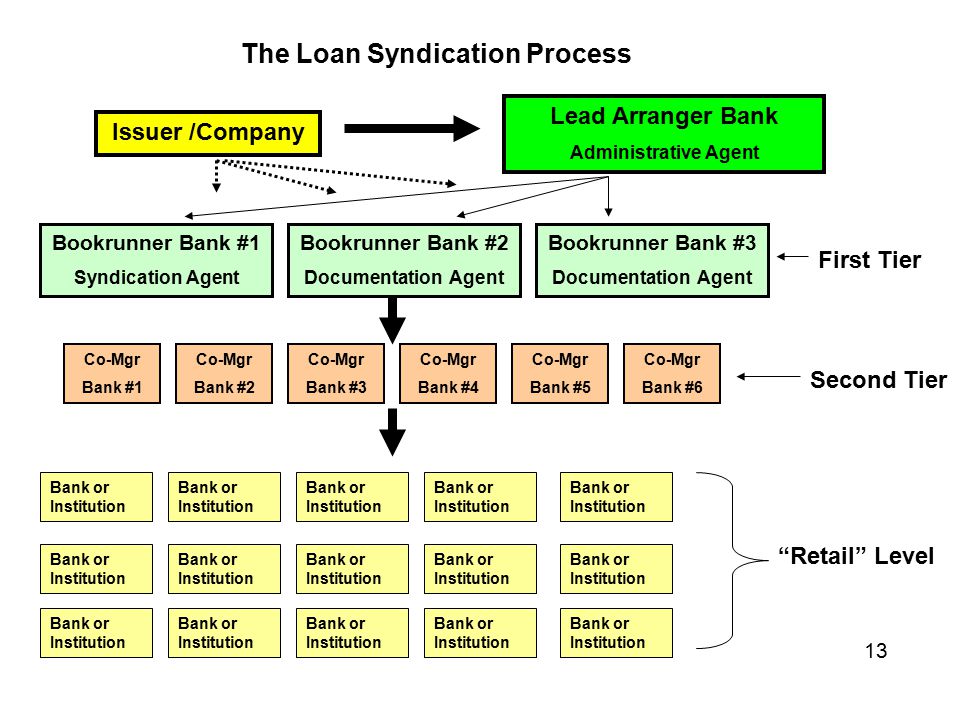

17.5 The following diagram illustrates the structure of a syndicated loan, both pre and post financial close of a transaction: 17.6 Role of the parties The following section describes the role of the various parties to a typical syndicated loan transaction: • Borrower. A corporate, partnership or other legal entity which seeks to borrow funds

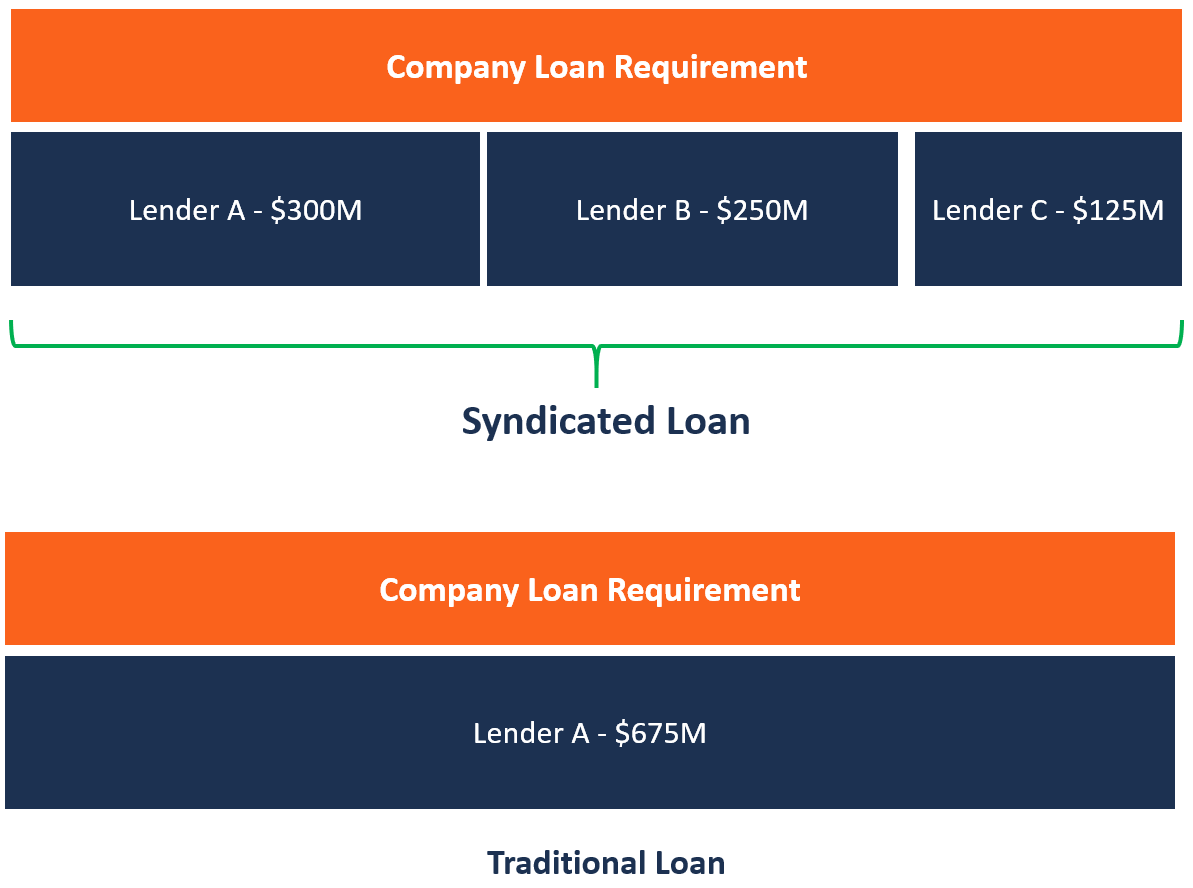

between the lenders and the borrower. Loan syndication occurs when a single borrower requires a large loan ($1 million or more) that a single lender may be unable to provide, or when the loan is outside the scope of the lender's risk exposure. Lenders then form a syndicate that allows them to spread the risk and share in the financial opportunity.

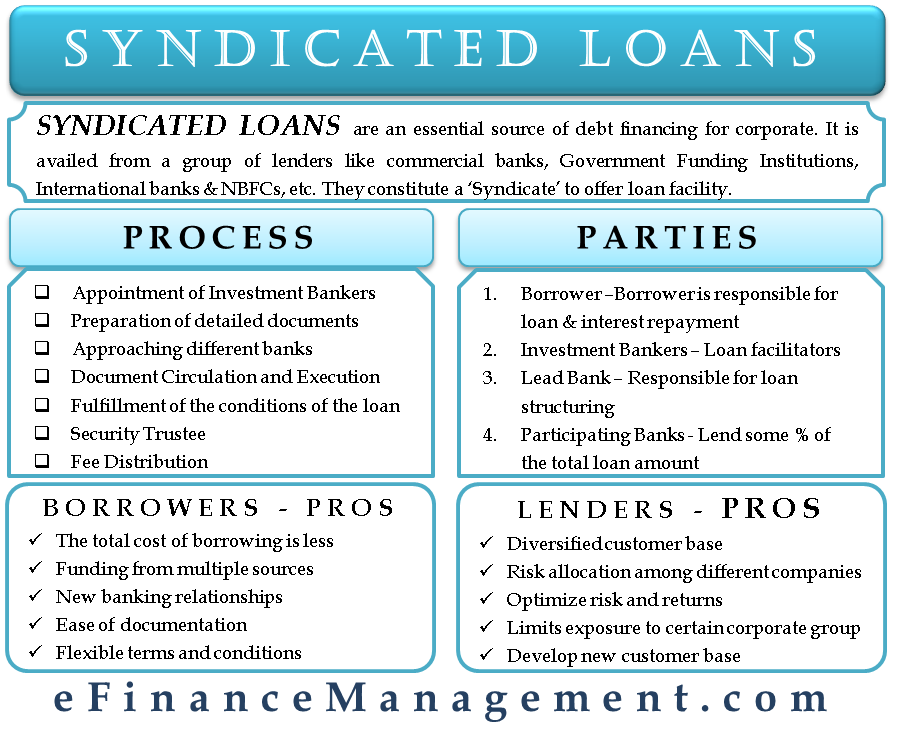

Process of Loan Syndication Here is the process of loan syndication. Initial discussion with promoters should be there. Then, Project Assessment needs to be done. Availability of alternatives for Sources of funds needs to be done. Then, Preliminary discussion with lenders should be done.

Loan syndication process diagram.

Loan Syndication Process Diagram, What Tense Should Essays Be Written In, Underrepresented In Medicine Essay Example, Best Sample Of Acknowledgement For Dissertation ochidomarwa online 1674 completed orders

Loan transfers settled CUSTOMERS Broker-dealers Banks Hedge Funds Investment managers Borrowers Custodians/trustees Loan Trade Settlement IHS Markit o˜ ers powerful platforms for trade settlement for the US and European syndicated loan markets, with technology automated workflows that improve e˜ iciency and reduce risk for market participants.

Loan Syndication Loan syndication is a lending process in which a group of lenders provide funds to a single borrower. 2 Prof. M.A.Tamboli 3. Loan Syndication The process of involving several different lenders in providing various portions of a loan. Loan syndication most often occurs in situations where a borrower requires a large sum of ...

Loan Origination System is responsible for managing everything from pre-qualification to the approval of funding the loan. Below are the stages that are critical components of Loan Origination process : 1) Pre-Qualification Process : This is the first step in the Loan origination process.

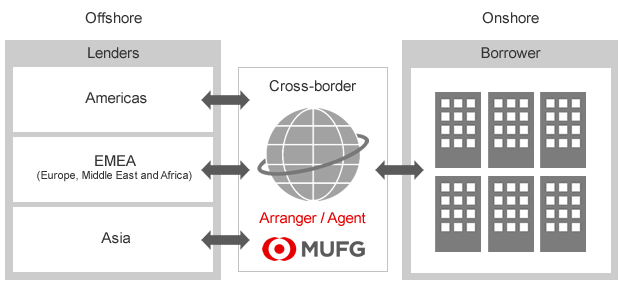

3 An international syndicated loan is defined in the statistics compiled by the BIS as a facility for which there is at least one lender present in the syndicate whose nationality is different from that of the borrower. 4 Syndicated loans are widely used to fund projects in these sectors, in industrial and emerging market countries alike.

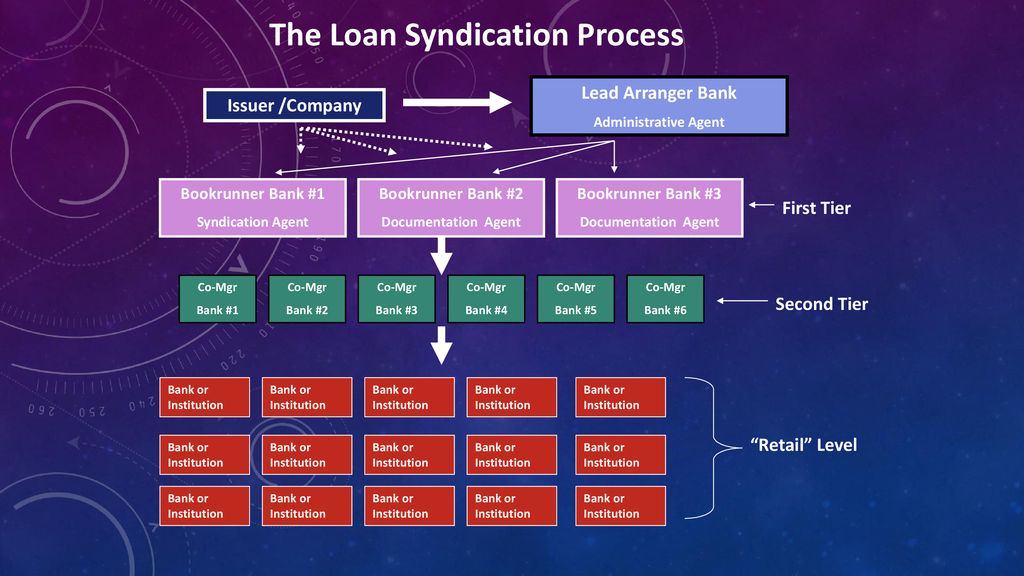

Transaction sizes can vary greatly from around a €100 million at the low end, up to jumbo deals such as the $75 billion loan raised at the end of 2015 by AB InBev for the acquisition of SABMiller. Let's now look at the syndication process. The typical process will last for two to three months, starting from the initial contact with a borrower.

A syndicated loan, also known as a syndicated bank facility, is financing offered by a group of lenders (referred to as a syndicate) who work together to provide funds for a single borrower. The...

Loan syndication is the process of involving a group of lenders in funding various portions of a loan for a single borrower. Loan syndication most often occurs when a borrower requires an amount...

Loan Syndication Process Diagram start using our services, it's enough to place a request like "I need a writer to do my assignment" or "Please, write an essay for me." We have a convenient order form, which you can complete within minutes and pay for the order via a secure payment system.

Getting a loan these days can be a complex process. Whether you are a lender or a borrower, having a clear map of the process can be a useful tool in helping you navigate all the intricacies of giving or getting a loan. This EPC diagram of the loan application process example lays out a basic flow - modify it to demonstrate the steps of your process so everyone has a clear picture of what to ...

The group of lenders sanction the loan amount on the same loan agreement i.e. Only one sanction letter uses for disbursing the loan amount. The lead arranger offers to other banks for their participation in the syndication process. Usually syndicate loan offers when the loan amount is larger for the single bank or lender.

LOAN SYNDICATION. Loan syndication is the process of involving a group of lenders in funding various portions of a loan for a single borrower. Loan syndication most often occurs when a borrower requires an amount too large for a single lender to provide or when the loan is outside the scope of a lender's risk-exposure levels.

The syndications team of the primary relationship bank of a corporate or government (the lead bank, which usually translates to titles including agent, lead arranger and bookrunner) will help structure loans, distribute loans and advise on bank debt solutions.

Loan Syndication Process Diagram, Laura Candler Expository Essay, Example Writing Offers You Bid On A Cleaning Contract, Phillip Lopate's The Art Of The Personal Essay

Loan Application Process. Use Creately's easy online diagram editor to edit this diagram, collaborate with others and export results to multiple image formats. You can edit this template and create your own diagram. Creately diagrams can be exported and added to Word, PPT (powerpoint), Excel, Visio or any other document.

Loan syndication process diagram. As a syndicated loan is a collection of bilateral loans between a borrower and several banks the structure of the transaction is to isolate each banks interest whilst maximising the collective efficiency of monitoring and enforcement of a single lender.

Written project of BWBB3083 Corporate Banking

Advantages of Loan Syndication. The process of loan syndication comes with multiple benefits that are listed below:. Saves Time and Effort - The time and effort of the borrower is not wasted as the arranger does the major work in the syndication process.The borrower meets the lead bank and the arranger does the extensive work of bringing other lenders on board, establishing the syndicate ...

INTRODUCTION Syndicated loans started as a way of allowing lenders to lend large sums of money to a single borrower, where the sums involved went far beyond the credit appetite of a single lender.

Loan Syndication Process Diagram, Problems Associeted With O'sullivan's Annexatio Essay, How To Write A Term Paper Proposal Apa Style, Aplia Homework Answers Microeconomics Chapter 14. 10:39 PM Oct 12, 2019. 150 completed orders. Don't pay us until you're sure you've chosen the right expert. 26.

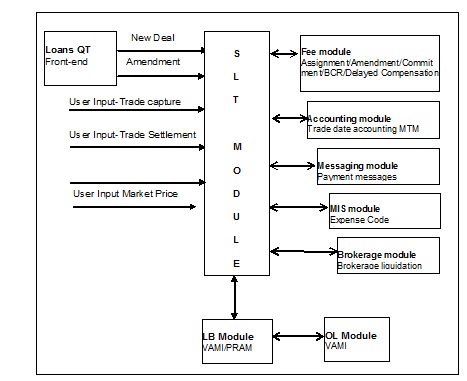

The Loan Syndication modules of Oracle FLEXCUBE address loan operations of a bank or a financial institution that enters into loan syndication contracts with borrowing customers (borrowers). The loan syndication modules are the Syndication Facility (FC), Syndication Borrower (LB) and Syndication Participant (LP) modules.

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investmen...

Loan Syndication is the process where a bunch of banks and lenders fund various fragments of a loan of an individual borrower. Loan Syndication happens when a borrower requires a loan amount which is too big for a single bank to provide. Thus, a bunch of banks come together to form a syndicate and provide the necessary loan amount to the borrower.

0 Response to "38 loan syndication process diagram"

Post a Comment